Research-based selling is an approach that SimplyDIRECT pioneered more than two decades ago. We begin by executing proprietary demand-generation surveys to gather the inside information sales needs. Then we conduct a strategy session to help your sales team understand how to use the information for the competitive advantage they need to outmaneuver competitors.

Research-based selling is an approach that SimplyDIRECT pioneered more than two decades ago. We begin by executing proprietary demand-generation surveys to gather the inside information sales needs. Then we conduct a strategy session to help your sales team understand how to use the information for the competitive advantage they need to outmaneuver competitors.

Starting with the right candidates

They’re a director, or a VP. Their company has X number of employees. They might have a job title with a specific keyword or maybe you’re targeting someone based on their job function. That’s fine. We’ll either perform database cleansing on the contacts you provide or we will conduct a new contact discovery to deliver a honed list of custom-researched names. Unlike most lead generation companies, we start with only the people or personas that you want to talk to. And then – we launch the survey into this list, which has been crafted to find out what you really want to know.

Our surveys are customized for the specific audience and then deployed by SimplyDIRECT’s research branch, Gatepoint Research. Each four-minute survey offers an incentive or a “penny for your thoughts.” And who doesn’t like to share their opinion on a topic that is near and dear to them?

Research-based selling

Imagine you’re selling ERP software. Wouldn’t it be great to know what system your prospect currently has in place and for how long? Even better are the answers to questions like these:

- Do you experience any challenges with your current ERP system?

- How satisfied are you with your ERP system?

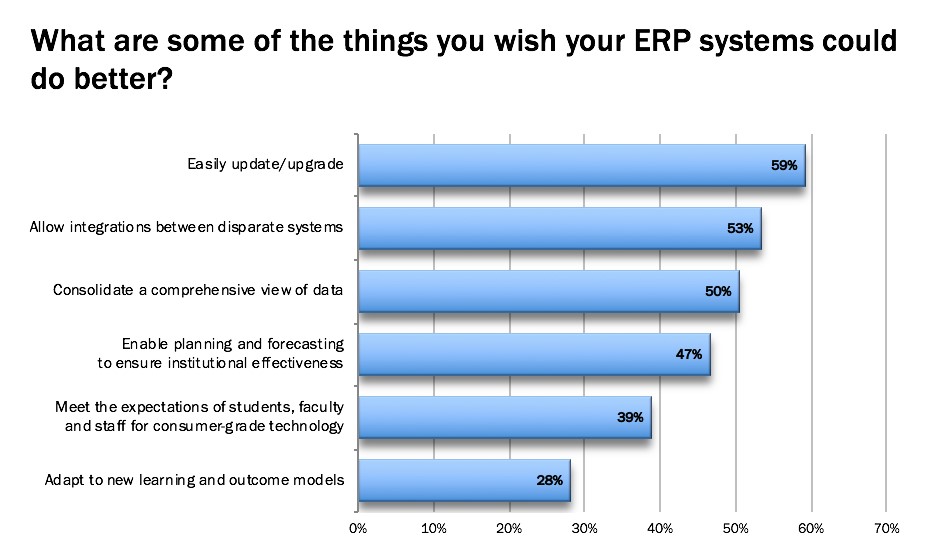

- What are some things you wish your ERP system could do better?

These are the types of questions our surveys ask. The answers to these questions enable research-based selling where you can tailor your pitch to the clients’ pain points.

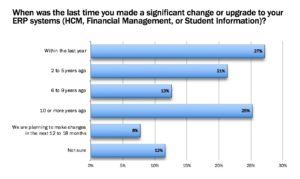

Here are some actual results from a survey deployed to the target audience of an ERP solution provider.

Almost two-thirds, 59%, of respondents wanted a system that could be upgraded easily. Just over half wanted integration between disparate systems. Exactly half wanted a consolidated, comprehensive view of data.

A quarter of respondents admitted that their ERP system was 10 or more years old. Some of the respondents indicated that they already have plans in place to make a change.

Just think how powerful these research results would be if they were yours? While these charts show the tallied answers of all respondents, their individual answers are made available in a web-based dashboard so salespeople know exactly how each person answered the questions.

What could you do with that knowledge?

Key qualifiers and who to call first

Most likely, you’d contact the folks who are specifically planning to make a change first, followed by the people who have had their existing system in place for 10 or more years. Or perhaps your key qualifiers are related to a specific competitor or pain point. You have done a competitive analysis and you have heard others talk about similar challenges. You can get right to the point without wasting anyone’s time. You know what is important to the prospect and presumably how your solution would fill their needs. There are many points of entry you can use with research-based selling. You can even package the research results into content assets to market to people who didn’t participate in the research.

Our happy clients include industry leaders like IBM, Oracle, Salesforce, and Workday as well as many niche companies. Download the executive brief: “Research-based Selling: Using Survey Intelligence for Sales Advantage.”